📈Aventabot

Be careful, no strategy, no matter how good it may be, will guarantee you success! Many external parameters can hinder the smooth running of a Trade in progress.

Also pay attention to the phenomenon of over-optimization. Indeed, the more a strategy is over-optimized, the more the chances that it will fail increase.

Presentation

The Aventabot automated script represents a counter-trend Day Trading/Scalping strategy available for the Cryptocurrency market only.

It operates on the H1 time unit only and will act during strong volatility movements.

Unfortunately, it is sometimes difficult to take a position because the price will create a "liquidity wick", this particularly happens on pairs with low liquidity.

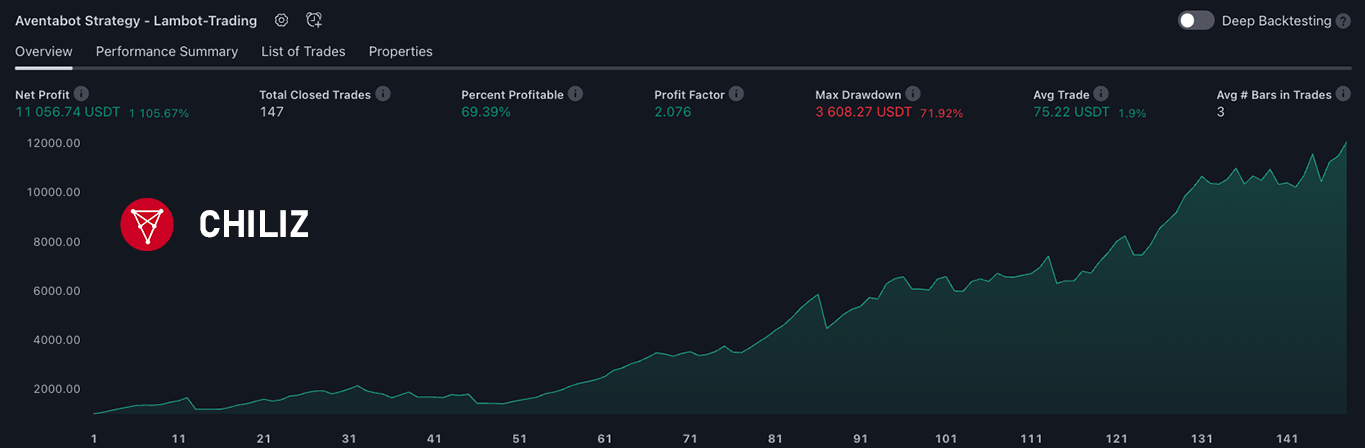

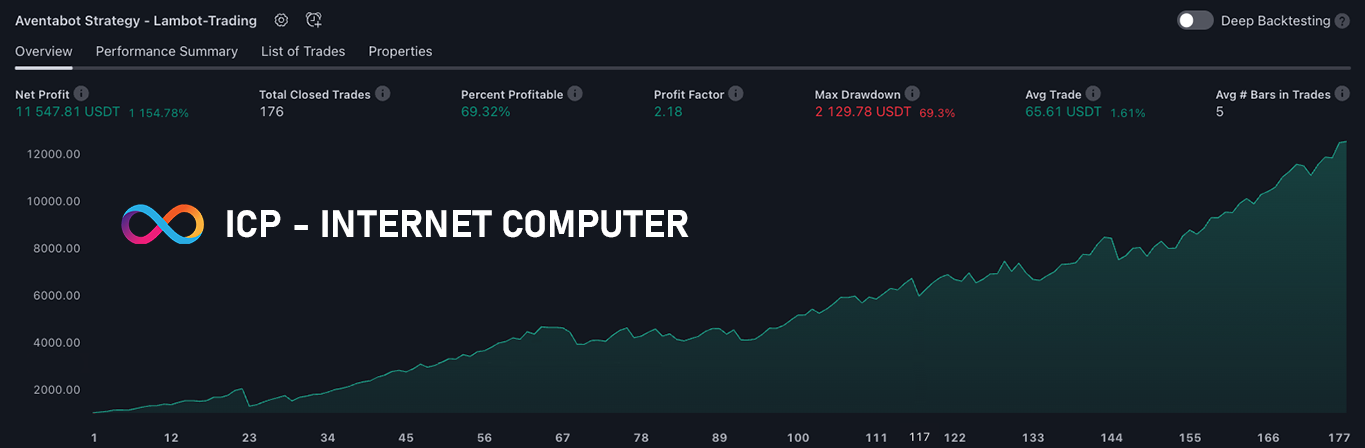

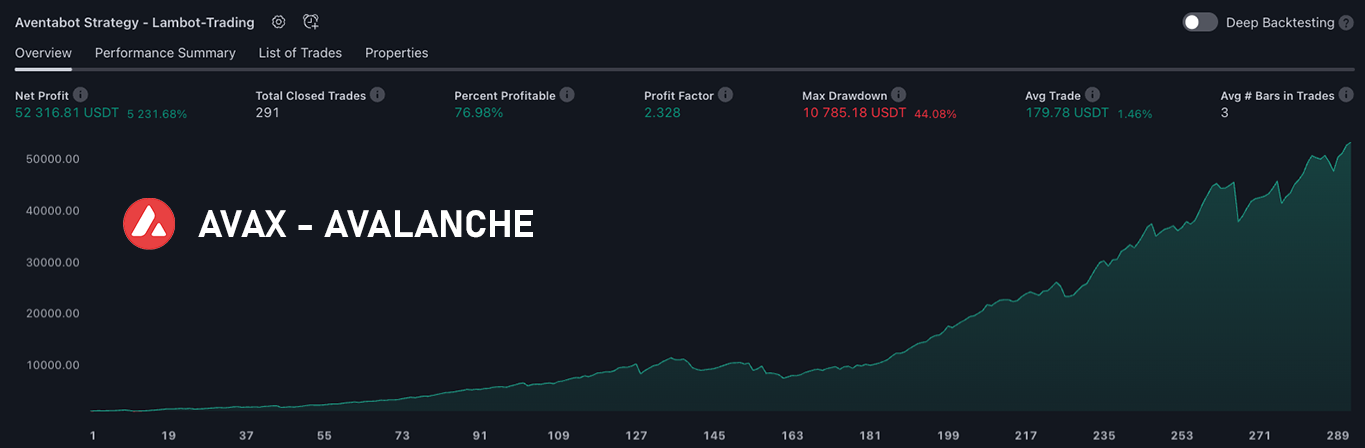

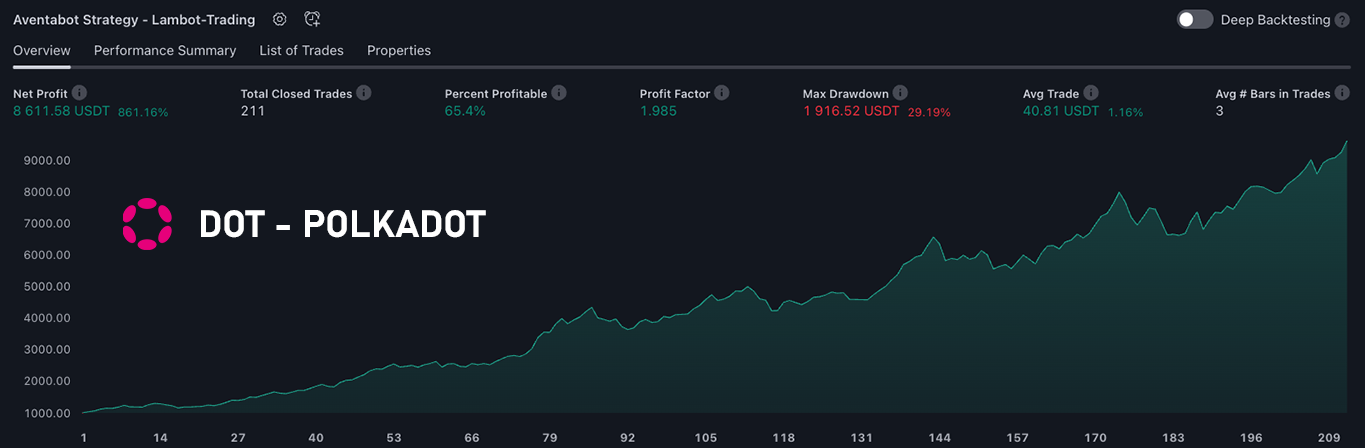

Backtests

Backtests carried out on 26,000 candles, or approximately 1000 days in December 2023. That is, during the entire Bear Market period!

The results of your backtests depend on the level of your TradingView subscription. For example, free accounts are limited to 5,000 candles.

Don’t hesitate to ask us to carry out backtests for you!

Settings

Version: the strategy offers 8 "versions". These are predefined sets of parameters.

Profile: define your investor profile here, “aggressive” or “conservative”.

Boost (optional): you can adjust the momentum expected by the strategy.

Bar index (optional): allows you to limit the backtesting period, for better backtests, it is recommended to leave it at 25. Some graphic charters may contain data errors. TradingView will then display the number of the candle concerned, enter this number here to be able to display the strategy.

When you are on the 1 hour time unit. The strategy will automatically display a summary table.

The start date of the backtest,

The number of candles taken into account and the equivalent in days,

Recall of selected parameters,

Average duration of an open position.

TV to DEX

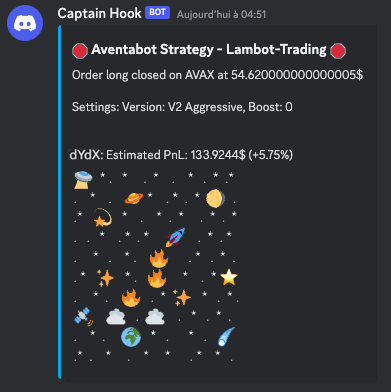

This section is reserved for owners of the TV to DEX bot allowing them to execute PERP orders on decentralized platforms such as dYdX, PancakeSwap, etc.

The checkbox is used to activate the connection with the TV to DEX DApp,,

Send to: choose your DEX, dYdX, Vertex, PancakeSwap, etc.

And:choose the social network(s) where you want to receive all the detailed reports,

Bot Pass 🔐: the password you provided when installing the DApp,

Start date: indicate here the date on which you activate the alert, you must not have any apparent order in your backtests, this can distort position sizes,

Then indicate whether you want to activate the "% of Equity" option or indicate a fixed position size yourself,

Max. Positions: enter the maximum number of positions you agree to take with the Aventabot strategy,

Choose how the DApp will manage your stop, "Automatically", "TP + BE", or with a "Trailing Stop",

Qty: enter here either the percentage of TP to take if you have selected "TP + BE", or the percentage at which you wish to place your Trailing Stop.

Start by checking the box to the left of “Send to”. The table at the bottom right of your TradingView chart will change color and show you a complete summary of the position you have defined.

The launch date of the strategy: this allows you to compare your results to those of TradingView over the long term,

The selected DEX,

The social network(s) where you wish to be notified of each action taken by the DApp,

The Initial Capital that you indicated in the “Properties” of the strategy,

The estimated position size in USD and the equivalent depending on the chosen asset,

The maximum number of positions you agree to take in total with this strategy,

The type of stop selected.

Personalized alerts from TradingView users

This section is reserved for TradingView alerts and not those sent by the TV to DEX DApp

Alerts Title: you can modify the titles for your bullish, bearish alerts and for position exits.

Alerts Message: you can customize the body of your alerts for which positions open and which close.

All words located in double braces: {{variables}}, are variables offered by TradingView, in order to display different information about your current position, you can consult the list here.

Personalized alerts from TV to DEX users

Please refer to the documentation provided with the TV to DEX DApp to customize your alerts.

Properties tab

This tab represents the financial part of the strategy. You must have precise and thoughtful “Money Management” before getting started.

There are as many ways to manage your risk as there are traders, you need to find something that works for you!

Initial capital: indicate here the total capital allocated to this strategy and on this asset,

Base currency: the base currency, you can leave "Default",

Order size: indicate here the position size according to your risk management,

Pyramiding: maximum number of positions in the same direction. You have to leave it on 1,

Commission: indicate here the % commission requested by your broker for “Taker” orders. This varies between 0.02% and 0.10%. For example MEXC and dYdX offer 0.05% Taker fees.

Enable alerts

To not miss any position, you can activate alerts.

Start by setting up your strategy, then click on the three-dot menu and finally click on "Add alert on Aventabot Strategy - Lambot-Trading"

A window appears with two tabs. In the Settings section, there is nothing to change.

In the Notifications section, you can customize the sound of alerts from the TradingView application/website and choose what kind of alerts you want to receive.

With the TV to DEX DApp, you can only check "Webhook URL" and let the DApp manage the alerts.

Last updated